Thinking about Sector Allocation in Inflation

The claim:

Specific equity sectors – particularly semiconductors, mining / energy, pharmaceuticals and healthcare, and real estate– have shown over time to be relative beneficiaries of higher inflation. Substituting these for a portion of a portfolio’s equity exposure (say one-quarter) can be shown to increase portfolio performance and resilience during periods of rising inflation.

The rationale:

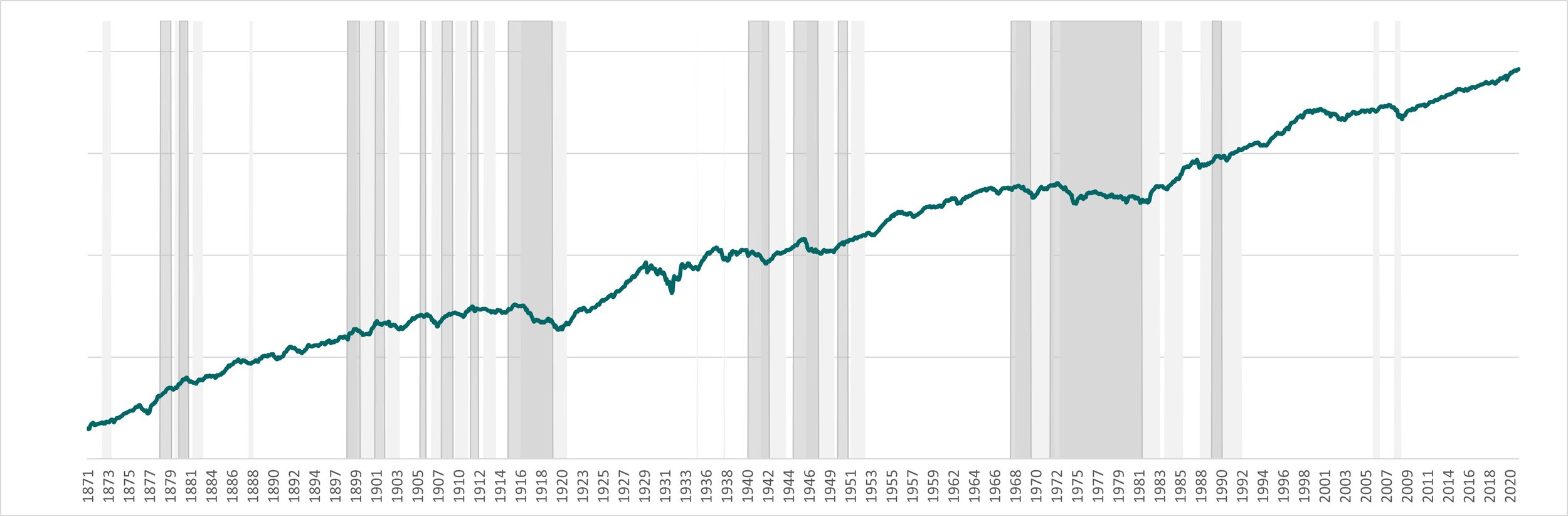

Modern portfolio construction is heavily reliant on a negative correlation of bonds and equities. Bonds tend to compensate for poor equity performance during periods of weak economic growth. However, periods of higher inflation tend to result in poor performance for the standard 60:40 (equity/bond mix) portfolio. Chart 1 shows the real (inflation adjusted) performance of a 60:40 portfolio when inflation exceeds 3% (light grey) and >5% (dark grey).

Chart 1. Scale is logarithmic to show growth trajectory; horizontal axis is year. References: Robert J Shiller dataset; Own Calculations

The intuition:

Sectors that are more resilient to rising inflation pressures tend to have the following characteristics:

- High operating leverage: meaning a small change in revenue leads to a larger variation in profitability

- Low asset turnover: revenues quickly ‘index’ to higher price levels but the assets used to produce those revenues do not need to be replaced quickly (i.e. they have long depreciable lives)

- Produce essential inputs or raw materials for the economy: higher inflation tends to weaken demand for many goods and services (discretionary spending gets put on hold)

Semiconductor fabrication factories require enormous investment but firms tend to have high operating margins in part due the market structure. The pharma sector has similar characteristics (e.g. high fixed / low marginal cost due to R&D and high profit margins due to IP). The mining industry combines production of “essential raw materials” with assets that have lifespans over decades, so input costs are slower to respond to higher inflation. Real estate – particularly housing – is an ‘essential’ good with a long depreciable life with very high operating leverage. For more details on how the industries stack up, see: Appendix.

The evidence:

The table charts below show a time series of real (inflation-adjusted) returns for the various equity sectors.

Sources: NAREIT; Fama-French data set; Own Calculations. Notes: Inflation Portfolio weighted by risk.

Chart is logarithmic to show growth rates. Areas shaded dark grey are periods with CPI >5% (light grey areas 3%+)

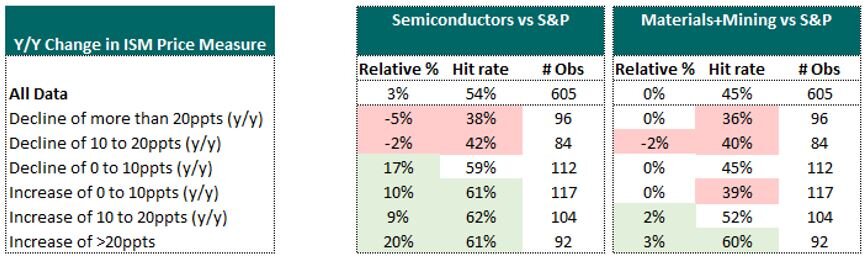

The performance of inflation beneficiaries that have cyclical demand (such a semiconductors or mining) show a strong correlation with business surveys of inflation like the ISM.

Semis: 1970-1977: Equal-weight index of: Advanced Micro Devices (AMD), SkyWorks (SWKS), and Texas Instruments (TXN). For 1977-1995: includes also Analog Devices (ADI) and Intel (INTC). From 1995: PHLX Semiconductor Index

Materials/Mining: 1970 to present: Equal-weight index of: Alcoa (AA), Vulcan Materials (VMC), Dupont (DD), Newmont (NEM), and Carter Technology (CRS)

Pharmaceutical and healthcare firms tend to do well in difficult economic environments – both very low inflation environments and very high inflation, which may reflect a fairly inelastic demand curve. NB: the performance of medical equipment firms seems to fade at very high levels of inflation.

The timing:

A fairly good predictor of near-term inflation developments in the U.S. (with a 1-2 month lead) is the development of producer prices in the countries that the U.S. imports most from (e.g. China, Mexico, and East Asia), the y/y currency changes in those countries (against the US$), as well as the change in the price of gasoline. This simple relationship would suggest that a cyclical element of inflation may ebb in coming months.

Looking further out there should be underlying support for inflation readings as the cost of rent and housing (combined c. 40% of CPI) recovers from the impact of eviction moratoria and the effects of reduced mobility.

Appendix: