China’s re-opening — timing and implications

China’s zero-covid policy has become less effective in containing the virus. The head of the Chinese CDC and others have stated several months ago that the policy could change when China achieved 85% vaccination rates — it is now at 87%. Omicron shifts the calculus in both directions: containment and vaccination are both less effective. What is telling is that China two weeks ago approved its first foreign-developed Covid treatment from Pfizer. While the near-term scale of this solution is probably inadequate for more than a few million courses, it may be a signal of intent. Moreover, the former head of the Chinese CDC suggested today that China could learn to live with the virus and that “in the near future, at the right time, the roadmap for Chinese-style co-existence with the virus should be presented”.

China’s ‘two sessions’ meeting is often used to ‘introduce plans for the future’ in the year ahead. With that in mind, this year meetings on 4-5 March might be worth watching for indications of a re-opening timeline.

Why would a policy shift be made now?

China needs to accelerate domestic demand. Surveys of small businesses report that operating conditions have deteriorated notably in recent months given the pressures in the real estate market and the domestic tourism and hospitality sectors; the export sector is unlikely to provide much support to the economy. An end to Covid-zero policies would likely mean higher levels of consumer spending. Unlike in most of the rest of the world, nominal retail sales are still far below pre-Covid trend levels.

There are of course political considerations to re-opening with the 20th party congress in late 2022. While most assume a continuation of the status quo with leadership continuing on after 2022 (here and here), there are some undercurrents suggesting it is not a foregone conclusion.

Property price uses average of Shanghai, Guangzhou, Shenzhen, Tianjin and Nanjing. Sources below.

But will China be “pushing on a string”? History shows that China consumer confidence is deeply entwined with developments in the property sector (right). While property curbs have been relaxed, it could be that directed stimulus will be required.

The IMF has recently suggested that China’s shift stimulus away from its traditional areas (infrastructure investment) and toward consumption-led growth. Michael Pettis, professor of finance at Peking University, notes that the IMF does not stray too far from the establishment view within China, in order to remain relevant. China’s digital currency is ideal for consumer stimulus because it is programmable. Disbursements could be targeted, for example only allowing certain purchases or by expiring by a certain date. It could also fit well with a ‘common prosperity’ focus. Recent editions of the People’s Daily and also SCMP/Xinhua in late January highlighted a growing push for ‘green consumption’.

What would the broader effects of re-opening and consumption-led growth?

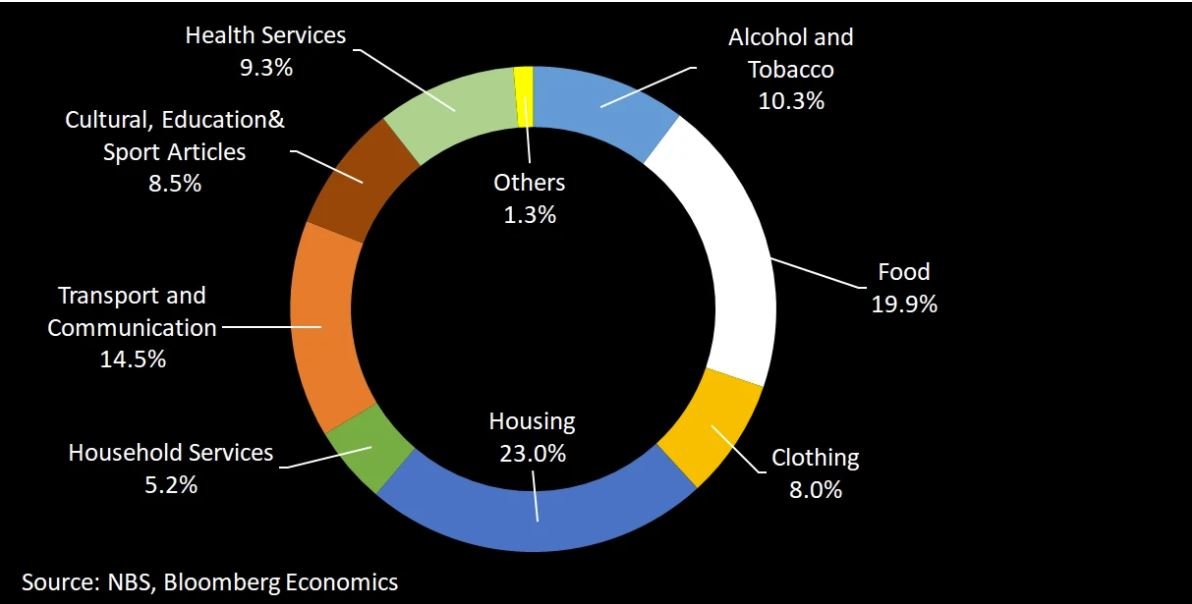

The split of consumer spending in China in not precisely known, but Bloomberg News has made an attempt to reconcile this from NBS releases. The chart below highlights a much larger share of food, alcohol and tobacco, and clothing versus in the US. This is probably particularly true for lower economic strata of society - the focus of ‘common prosperity’. Suffices to say this will probably add to inflation pressures in agricultural commodities (and goods generally), but potentially reduce these pressures in the areas more geared to infrastructure (e.g. iron/steel).

Sources:

Property price source: "Demystifying the Chinese Housing Boom" by Hanming Fang, Quanlin Gu, Wei Xiong and Li-An Zhou.