The short-term story on inflation

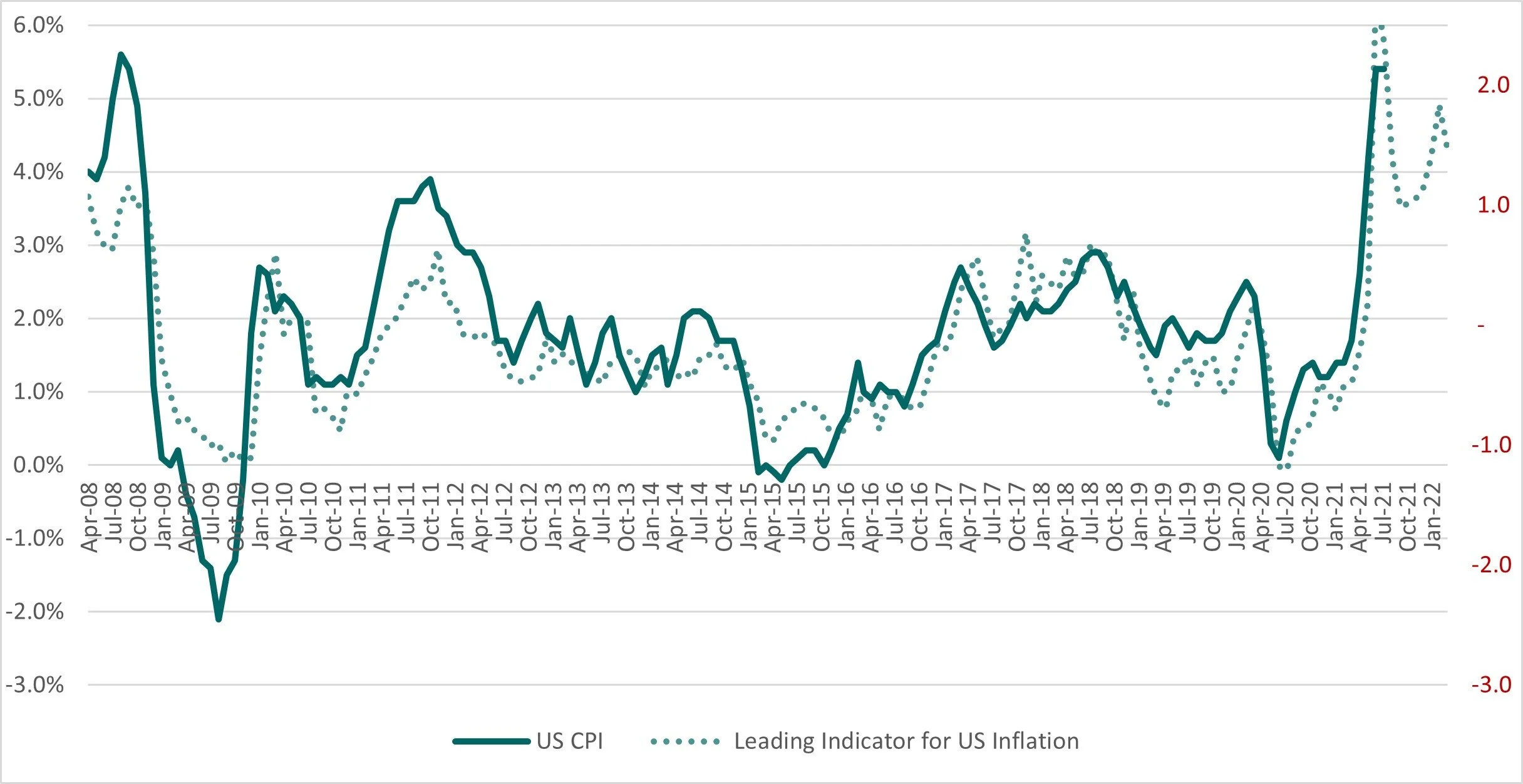

Just a point of clarification — in the near-term inflation pressures are likely to reduce.

This is mainly due to base effects for commodity prices (especially gasoline) and the dollar, albeit with an increasing offset from housing/rents. For the amplitude next year, it will be important to monitor the trend of stimulus out of China. Producer prices in China have a strong relationship (R-sq of ~50%) with money supply (M1) in China with a lag of 10 months.

China producer prices are relevant given the connection this has with US consumer prices.

The leading indicator of US inflation incorporates the PPI in China, change in the Yuan / $ exchange rate (y/y), gasoline prices (y/y), as well as rent projections (based off of Zillow). It produces an R-sq of 0.76 historically. Projections incorporate a unchanged FX rate and gasoline prices and a rough estimation of China PPI based on the relationship above.